Taxing private schools ‘could make them more elitist’ and ‘add pressure to state schools’

- Written by George Lythgoe

- Last updated 8 months ago

- Family & Kids, Trafford

Taxing private schools could lose Labour the Altrincham and Sale West seat at the general election, according to concerned residents.

Talk of Labour’s pledge to end private schools’ VAT exemption and business rate relief has been rife at the school gate in the leafy suburbs on the border of Cheshire and Manchester. With a string of fee paying schools in operation across the parliamentary constituency, this particular policy, which Labour believes would provide extra cash for state schools, is a hot topic amongst locals in the build up to polling day on July 4.

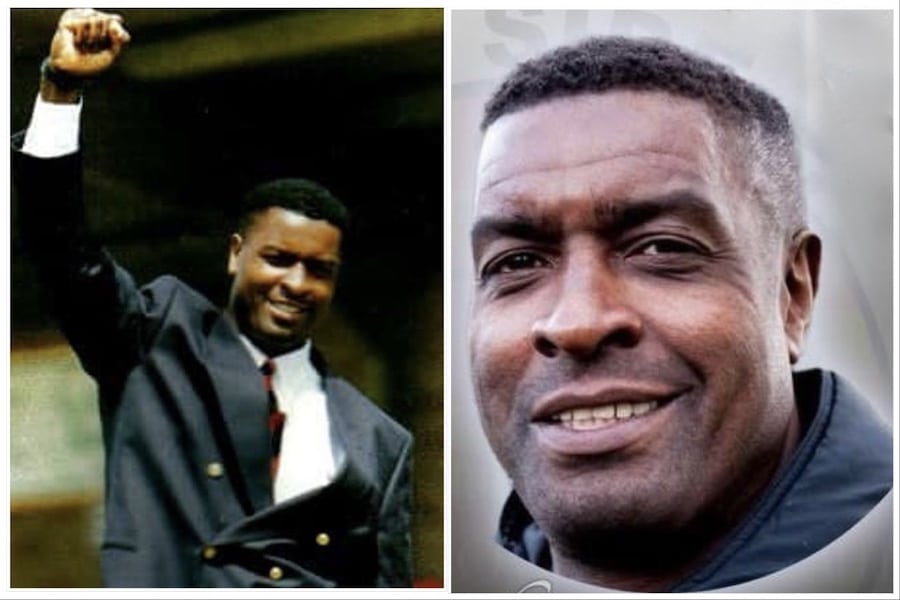

The high profile Conservative MP Sir Graham Brady, known for his role as the chair of the 1922 Committee, has stepped down at this election – which has led the blues’ rivals to think its a seat ripe for the taking.

The senior backbench politician has held the seat for the Conservatives since it was created back in 1997, but the area has always been a safe Tory seat even under its previous constituency name of Altrincham and Sale.

Across the country, many seats once thought to be Tory strongholds are thought to be targets for Labour, and this one is no different. However, if you believe the Conservative candidate taking over from Mr Brady, the plan to start slapping private schools with VAT could be a sticking point for Labour.

Many families in the area fork out thousands per year to send their little ones to one of the private schools in the area. Now there is a concern additional tax could price them out of this option, with many families taking extra shifts at work to be able to afford the current costs.

One mother, whose daughter is now ‘thriving’ at a fee paying preparatory school in the Altrincham area, says this is the talk of the town.

“I think the Labour Party are pushing the rhetoric that all private schools are massively elitist establishments that are amassing fortunes. They are not all as big as they are made out to be.

“My husband works full-time as a doctor and picks up extra shifts so we can afford it. My daughter didn’t settle at pre-school and she has really thrived at the private school.”

Concerned that school fees could go up if Labour were to come into power and impose the new taxes on private schools, the young mum added: “Taking choice away from parents can’t be the right thing to do. Here schools don’t all work for massive profits, they could have to close or raise school fees to cope.

“If this was a good idea, many other countries would do it. Some parents are not going on holidays and picking up extra shifts like my husband.

“It is very much a hot topic at the school gate because everything is so uncertain.”

She went on to claim that this could impact the economy, with parents less likely to pick up extra shifts if they don’t need to, reducing income tax and some schools having to close or make redundancies. She believes this would impact Labour’s plan to use the money from this tax exemption lift in order to better fund state schools.

A focus group from Altrincham run by Jim Blagden, from not for profit organisation More In Common, shared these concerns – but with more of an emphasis on where the money from this tax would go. Alicia, who works in a local school, believed this would hinder rather than help state schools, as the added cash burden could see more children move from private schools to state schools.

Another local parent, Eve, said there needed to be clarity over how this money would be used, would it be on equipment or employing more staff. Eve shared fears that these schools could become ‘more elitist’ because only parents on megabucks would be able to afford to send their children to private schools.

Many participants in the focus group were not against the idea of taxing private schools, but questioned how this could actually benefit state schools as the Labour Party suggested. There was a large majority who believed this would only add to the pressure state schools are under, with the main concern being for the parents who can only just afford the fees now being forced to send their children to state school instead.

Jim Bragden, who ran the Altrincham focus group, said: “Labour is hoping to win in Altrincham for the first time in the party’s history, a seat that has been Conservative for exactly 100 years. But some of Labour’s most popular policies, such as charging VAT on private school fees, don’t pass the sniff test with key voters in Altrincham.

“These voters, who backed the Conservatives in 2019 but would now switch to Labour, are deeply sceptical of the benefits to state schools and fully expect politicians to break their promises. If Labour is to keep these key voters on-side they need to break this cycle of constant disappointment and quickly get to work improving public services.

“If not, their support could rapidly melt away.”

Oliver Caroll, the Conservative candidate for the area at the upcoming general election, claims this is a major issue that has come up on the doorstep and in conversations with local independent schools. He claims that many prep schools in the area he’s spoken to are worried for their futures, whether this means raising fees or job cuts to make up for the loss of income due to the tax.

Labour candidate for Altrincham and Sale West, Connor Rand, said in response to these claims, said: “This is desperate stuff from the Tories, running scared in a constituency they’ve held since its creation 27 years ago. 14 years in government and they’ve got nothing but attacks and fear mongering.

“I am proud of the positive campaign I’ve run here in Altrincham and Sale West focused on local issues and the fresh vision Labour has put forward for our country. If people here want change, they need to vote for it by voting Labour on July 4.”

- This article was last updated 8 months ago.

- It was first published on 27 June 2024 and is subject to be updated from time to time. Please refresh or return to see the latest version.

Did we miss something? Let us know: [email protected]

Want to be the first to receive all the latest news stories, what’s on and events from the heart of Manchester? Sign up here.

Manchester is a successful city, but many people suffer. I Love Manchester helps raise awareness and funds to help improve the lives and prospects of people across Greater Manchester – and we can’t do it without your help. So please support us with what you can so we can continue to spread the love. Thank you in advance!

An email you’ll love. Subscribe to our newsletter to get the latest news stories delivered direct to your inbox.

Got a story worth sharing?

What’s the story? We are all ears when it comes to positive news and inspiring stories. You can send story ideas to [email protected]

While we can’t guarantee to publish everything, we will always consider any enquiry or idea that promotes:

- Independent new openings

- Human interest

- Not-for-profit organisations

- Community Interest Companies (CiCs) and projects

- Charities and charitable initiatives

- Affordability and offers saving people over 20%

For anything else, don’t hesitate to get in touch with us about advertorials (from £350+VAT) and advertising opportunities: [email protected]

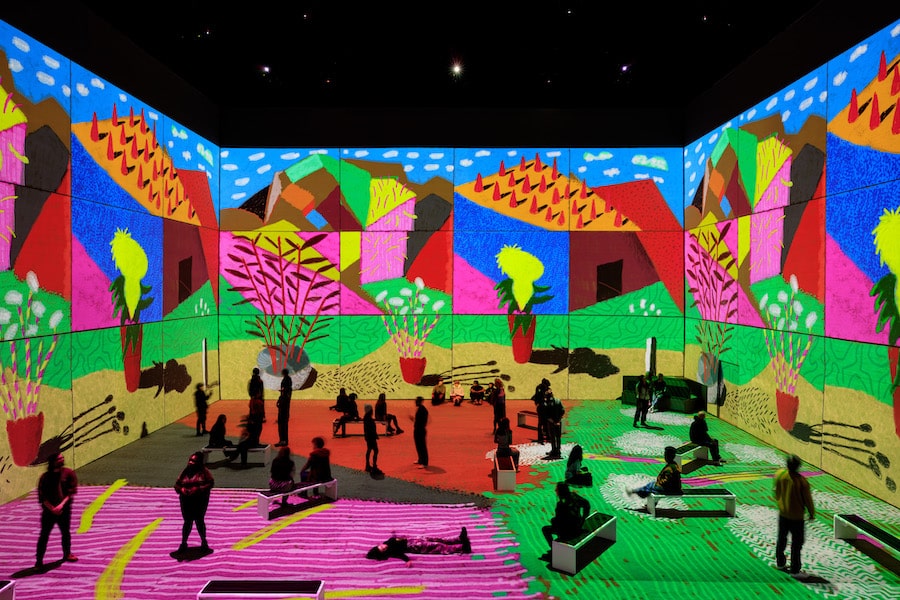

Lowry’s most iconic painting becomes a thrilling immersive experience

Five’s first full reunion in 25 years hits Manchester this Autumn